Below you can find a few of these concerns and the answers to them to help you shed light on the topic and clarify any worries you may be having. You’re only asked for a very limited amount of basic information to ensure your security and safety while using Cfd trader the platform. Some traders wish to register and trade without entering any basic information. Unfortunately, the platform can’t accommodate these traders, as it goes against the platform’s policies and is an unsafe and unethical way of conducting trades.

That is precisely why the most successful https://investmentsanalysis.info/s are typically seasoned investors with a wealth of experience and tactical acumen. Should this happen, you may get a margin call from your broker asking you to top up your account. If you don’t add adequate funds, the position may be closed, and any losses incurred will be realized. Additionally, a maintenance margin may be required if your trade is likely to suffer losses that the deposit margin, including any additional funds in your account, won’t cover.

A Must-ReadeBook for Traders

This guide has everything you need to know about CFD trading explained in simple terms. Crypto trading is also different from the asset mentioned above trading. This type of trading involves trading on the cryptocurrency itself, basing its cost on what its future value is going to be. The only amount you’re going to need to pay is the investment you wish to make. This investment is what you’re going to use to fund your trades and is completely yours.

- Cryptocurrencies are a recent addition to the trading world and can be described as digital assets that aren’t tangible, as these don’t exist in a physical form.

- Second, CFDs are not traded through regional transmission organizations (RTOs) markets.[citation needed] They are bilateral contracts between individual market participants.

- The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

- At City Index, we offer contracts on 1,000s of individual markets across shares, indices, currencies, commodities, interest rates, bonds and more.

- Although, there is a risk of loss if the market moves against you.

- They’ve encountered so many platforms with hidden fees and don’t wish to be another.

Some experienced traders set up more than one CFD account with the same broker to trade different assets or to follow alternative trading strategies. Some regulators require that new customers pass an ‘appropriateness or suitability’ test. This often means answering some questions to demonstrate that you understand the risks of trading on margin. It’s best to thoroughly educate yourself on how leverage and margin work before trading.

What is CFD Trading? CFD Trading for Beginners

Your net open profit and loss will now be realised and immediately reflected in your account cash balance. Alternatively, you can select the ‘close position’ option within the positions window. Once you’ve chosen a market, use the search function on the platform or app to find it. You’ll be able to see its live price, view a chart and take a look at all the information you need to know before taking your position. One major advantage of CFDs is the huge range of markets you can choose from.

Is CFD trading good for beginners?

Contracts for Difference, or CFDs, are a type of derivative product which allow traders to speculate on the price of an asset. CFD trading is readily accessible to beginner traders, relatively low cost and can be done entirely online.

Becoming a successful CFD trader takes skill, knowledge and practice. So, while you can mimic a traditional trade that profits as a market rises in price, you can also open a CFD position that will profit as the underlying market decreases in price. We offer a free demo account to all traders looking to practise their trades before opening a live account.

Countries Where You Can Trade CFDs

The margin calculator in the trading platform will automatically calculate how much you’ll need to open a position. This is what you’ll use to research new opportunities, open and close positions, manage your risk, monitor your P/L and more. Unlike traditional investing, you don’t take delivery of the asset. CFD trading enables you to sell (short) an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price move. If your prediction turns out to be correct, you can buy the instrument back at a lower price to make a profit. The majority of CFDs are traded OTC using the direct market access (DMA) or market maker model, but from 2007 until June 2014[15] the Australian Securities Exchange (ASX) offered exchange traded CFDs.

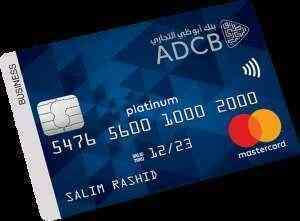

Will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. You don’t have to pay any registration, funding, or withdrawal fees with CFD Trader. The only money you need to use is your initial investment towards your first trades.

Countries that allow CFD trading

Take-profit orders reduce the likelihood of you holding on to a profitable trade for too long and seeing the price fall again. If Apple appreciates to $170, you make $10 a share – a $1,000 profit. If, however, the price falls to $150 a share, you lose $10 a share – a $1,000 loss. Additionally, professionals can also use the platform as a method of saving time in their live trading sessions. As professional traders, the team understands that trading can be incredibly time-consuming. That’s why the team has incorporated a user-friendly interface that can help you manage your time more effectively.

The Future of CFD Trading: Embracing Technological Advancements – Finance Magnates

The Future of CFD Trading: Embracing Technological Advancements.

Posted: Mon, 22 May 2023 13:56:21 GMT [source]

72% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. CFD traders, however, may be exposed to market, liquidity and execution risks in addition to costs that can cause losses or diminish potential profits. 71.98% of retail investor accounts lose money when trading CFDs with this provider. 86% of retail investor accounts lose money when trading CFDs with this provider.

Do CFD traders make money?

The simple answer to this question is that yes, it's possible to make money with CFD trading. The long and more realistic answer is that you first need to hone your trading skills and have a lot of discipline, practice, and patience to do well in the market.

Speak Your Mind